Overview

We strive to be the number-one private bank by value of service, innovation and sustainability.

Our key figures

Results at 31.12.2023AUM (miliardi)

Financial highlights

Results at 31.12.2023Results by line of business of the Bank are divided into: Private Banking and Wealth Management.

In light of the business nature, the Group assesses the performance of its operating segments on the basis of the performance of the net banking income attributable to such segments.

Private Banking

Private Banking business area results (table below) consists of the assets attributable to the network of Financial Advisors managing total client assets of less than 50 million euros, as well as the assets attributable to Relationship Managers and the respective clients.

Private Banking

| 2020 | 2021 | Change (%) | |

|---|---|---|---|

| Net interest income | 9,317 | 14,987 | 60.85% |

| Net fees | 302,067 | 381,347 | 26.25% |

| Net income (loss) from trading activities and dividends | - | - | - |

| Net banking income | 311,384 | 396,334 | 27.28% |

| AUM | 48,172 | 54,917 | 14.00% |

| Net inflows | 3,905 | 4,856 | 24.35% |

| Financial Advisors | 1,745 | 1,800 | 3.15% |

| AUM/FA | 27.61 | 30.51 | 10.52% |

| Net Inflows/FA | 2.24 | 2.70 | 20.55% |

5 years of results in the Private Banking area

| 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|

| Net interest income | 11,820 | 5,479 | 10,247 | 9,317 | 14,987 |

| Net fees | 242,683 | 248,866 | 287,395 | 302,067 | 381,347 |

| Net income (loss) from trading activities and dividends | - | - | - | - | - |

| Net banking income | 254,503 | 254,345 | 297,642 | 311,384 | 396,347 |

| AUM | 39,497 | 41,023 | 43,428 | 48,172 | 54,917 |

| Net inflows | 4,778 | 3,967 | 3,151 | 3,905 | 4,856 |

| Financial Advisors | 1,686 | 1,720 | 1,707 | 1,745 | 1,800 |

| AUM/FA | 23.43 | 23.85 | 25.44 | 27.61 | 30.51 |

| Net Inflows/FA | 2.83 | 2.31 | 2.24 | 1.85 | 2.70 |

Wealth Management

Wealth Management business area results (table below) consists of the assets attributable to the network of Financial Advisors managing total client assets of more than 50 million, in addition to the respective clients and assets of BG Valeur S.A.

Wealth Management

| 2020 | 2021 | Change (%) | |

|---|---|---|---|

| Net interest income | 5,206 | 8,363 | 60.64% |

| Net fees | 125,970 | 167,345 | 32.85% |

| Net income (loss) from trading activities and dividends | -81 | - | -100.00% |

| Net banking income | 131,095 | 175,708 | 34.03% |

| AUM | 25,830 | 29,897 | 15.75% |

| Net inflows | 1,961 | 2,829 | 44.27% |

| Financial Advisors | 354 | 374 | 5.65% |

| AUM/FA | 72.97 | 79.94 | 9.56% |

| Net inflows/FA | 5.54 | 7.56 | 36.56% |

5 years of results in the Wealth Management area

| 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|

| Net interest income | 4,702 | 2,451 | 5,192 | 5,206 | 8,363 |

| Net fees | 70,138 | 67,417 | 123,890 | 125,970 | 167,345 |

| Net income (loss) from trading activities and dividends | - | - | - | - | - |

| Net banking income | 74,840 | 69,867 | 129,061 | 131,095 | 175,708 |

| AUM | 15,634 | 16,055 | 25,235 | 25,830 | 29,897 |

| Net inflows | 2,206 | 1,334 | 2,349 | 1,961 | 2,829 |

| Financial Advisors | 250 | 265 | 333 | 354 | 374 |

| AUM/FA | 62.54 | 60.59 | 75.78 | 72.97 | 79.94 |

| Net Inflows/FA | 8.83 | 5.03 | 7.05 | 5.54 | 7.56 |

We stand apart within the Italian finance sector for the central role played by the financial advisory and wealth planning services it offers to the Private and Affluent Client segments through a network of Financial Advisors ranked at the top of the industry by competency and professionalism. The bond of trust between Financial Advisor and Client is key and is complemented by the range of products, services and support made available by the Bank.

Thanks to an open “approach” - as Hub Private - we always look at the best not only of the financial sector, but of innovation on a global scale, aggregating platforms, products and services, from the most successful experiences in each area of expertise. Our business model aims at sustainable growth in the long term, able to bring value, respecting the environment and the social objectives set, to all stakeholders who gravitate around society.

Our offer is made up of:

- Banking services: we provide our clients with a range of bespoke banking accounts and services that make doing day-to-day business simple and efficient. A line of innovative options that ensure the utmost security in online and mobile payments and banking.

- Assets under custody: we tend to the AUC component of our clients’ portfolios by providing advice on the purchase and sale of securities on the secondary and primary markets, in addition to offering certificates. We provide our financial advisors and clients with one of the world’s finest trading platforms, made possible by the partnership with the Danish Saxo Bank.

- Asset management: we offer a wide range of mutual funds within an open-architecture environment that benefits from its expertise in selecting the top asset management options from among thousands of asset management products offered by international firms. We also provide a market-leading line-up of wrapper solutions and discretionary portfolio management services, which can be used to design custom solutions –while always ensuring that risk management remains a priority.

- Insurance solutions: with regard to insurance investments, we profit from the synergies and expertise provided by the Generali Group, supported by our experience and pursuit of innovation in the use of asset management products to protect and personalise investments.

- Wealth management and trust services: we offer a wide array of financial advisory solutions that extend the conversation between families beyond investment issues to encompass pension planning, corporate finance, real estate and art advisory, with an eye to potential optimisation in protection for future contingencies and challenges relating to generational transfer (family protection).

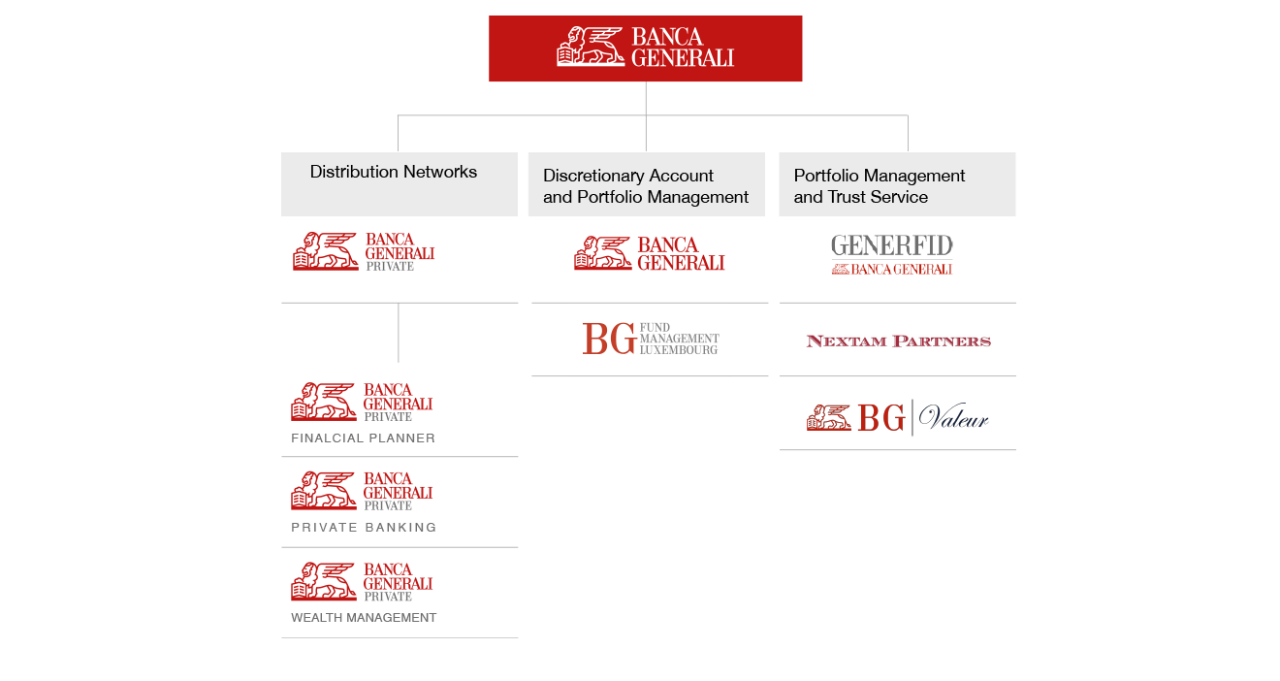

This range has been designed and is offered to the client with the support of a value chain consisting of:

- Networks: the client relationship is built on a network of financial advisors divided into various categories: Financial Planners, Private Bankers, Wealth Managers and Relationship Managers. Segmentation is designed to meet the needs of both Financial Advisors and clients to the fullest.

- Management companies: in addition to offering banking services, we include a management company, the Luxembourg-based BG Fund Management Luxembourg SA, responsible for offering in-house funds. We completed the acquisitions of Nextam Partners, a management boutique with a reputation in Italy’s private-banking sector, and of BG Valeur, a boutique financial advisory and asset management firm based in Switzerland. In 2018 the Bank also struck a partnership with the Danish Saxo Bank, which owns one of the finest trading platforms on the market, to create the brokerage BG Saxo. Finally, the Group also includes a trust services company (Generfid).

- Partnership: to bring our clients the best specialist services the market has to offer in terms of products, wealth management and technology, the Bank has formed selected partnerships with other firms in Italy and internationally.

Merger by incorporation of Nextam Partners S.p.A. and Nextam Partners SGR S.p.A. into Banca Generali S.p.A.

May 2020 – On the page Merger by incorporation of Nextam Partners S.p.A. and Nextam Partners SGR S.p.A. into Banca Generali S.p.A., the merger documents are available (in Italian language).

Merger of BG Fiduciaria into Banca Generali

October 2017 - On October 12, 2017, the Board of Directors of Banca Generali approved the merger of BG Fiduciaria.

On the page "Merger of BG Fiduciaria into Banca Generali", the project's documents are made available.

Merger of Bg sgr into Banca Generali

September 2012 - Bg SGR merged into Banca Generali effective 1 September. Creation of an autonomous portfolio management division within Banca Generali.

On the page "Merger of Bg sgr into Banca Generali", the project's documents are made available.

Company acquired: Bg sgr

January 2006 - The acquisition by Assicurazioni Generali and Generali Asset Management SGR is aimed at concentrating all of the Generali Group’s asset management activities focused on retail customers within Banca Generali.

Company acquired: Intesa Fiduciaria Sim SpA

June 2005 - The company was renamed BG Fiduciaria Sim, after being acquired from Banca Intesa.

Company acquired: Business Unit of Banca Primavera SpA

October 2003 - Banca Primavera, part of the Banca Intesa Group (now Intesa Sanpaolo), sold its network of approximately 1500 financial advisors to Banca Generali.

Company acquired: Metzler Italia Sim SpA

September 2002 - The company was subsequently renamed Simgenia Sim.

Company acquired: INA Sim SpA

2001 - The acquisition of Altinia Sim and INA Sim from Assicurazioni Generali increased the number of financial advisors (1552) and assets under management (€2.19 billion).

Company acquired: Altinia Sim SpA

2001 - See above.

Company acquired: Prime Consult Sim SpA

December 2000 - Acquisition of equity interest as a result of the merger of Prime S.p.A.

Company acquired: Prime SpA

December 2000 - The Assicurazioni Generali unit was merged into Banca Generali.