Banca Generali Corporate Website

Highlight

Highlights

The most recent communications, the results presentations, the updates and the events concerning the world of Banca Generali.

2025 Financial Results

Press Releases

Events

Strategy

Sustainability in BG

Our 2022-2024 Strategic Plan starts from the solid foundation built in the different phases of our development and aims to take full advantage of the favorable momentum in the financial advisory industry.

We aspire to strengthen our positioning in terms of sustainability: our goal is to be the benchmark in ESG for all our stakeholders.

We aspire to strengthen our positioning in terms of sustainability: our goal is to be the benchmark in ESG for all our stakeholders.

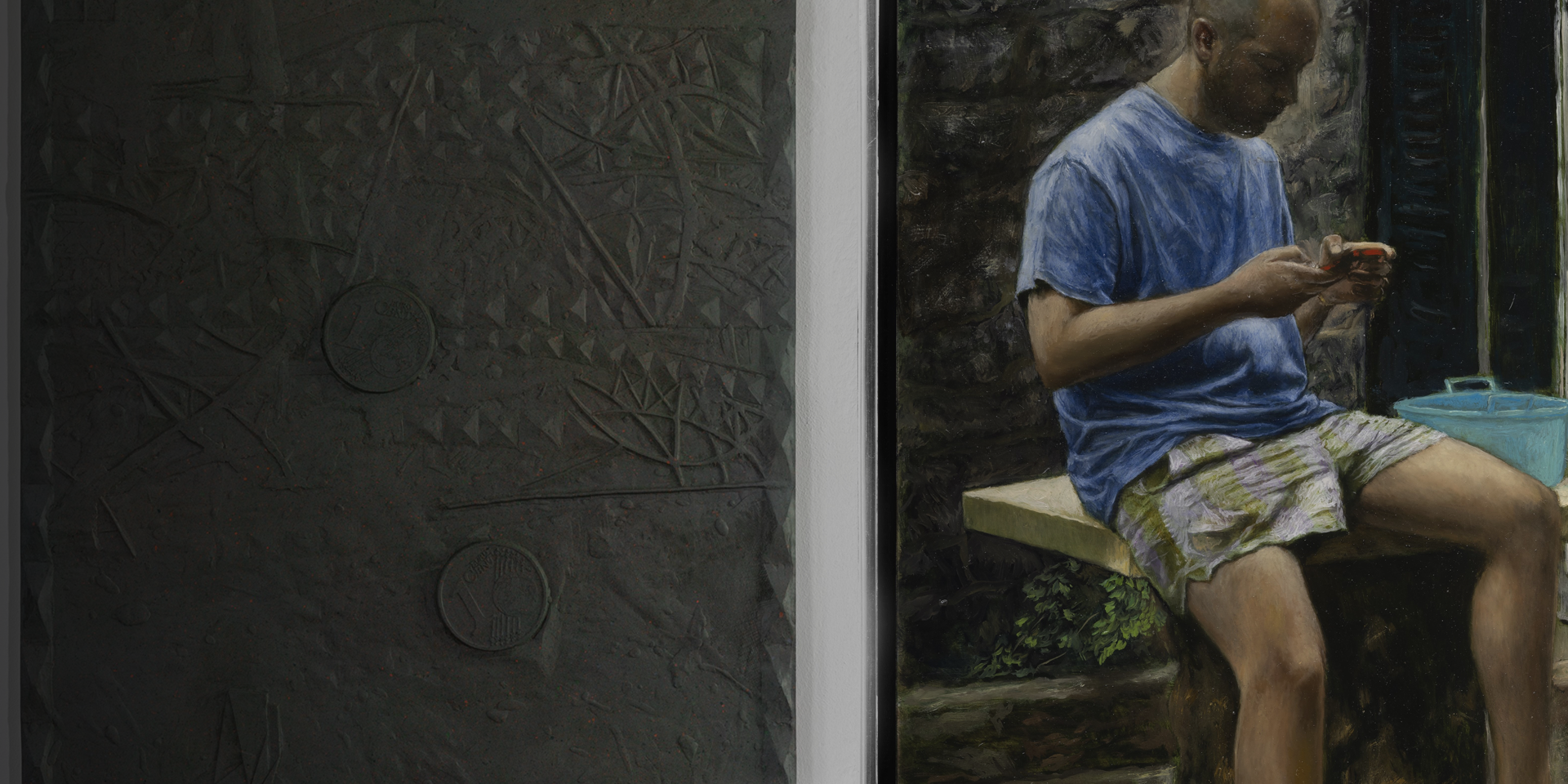

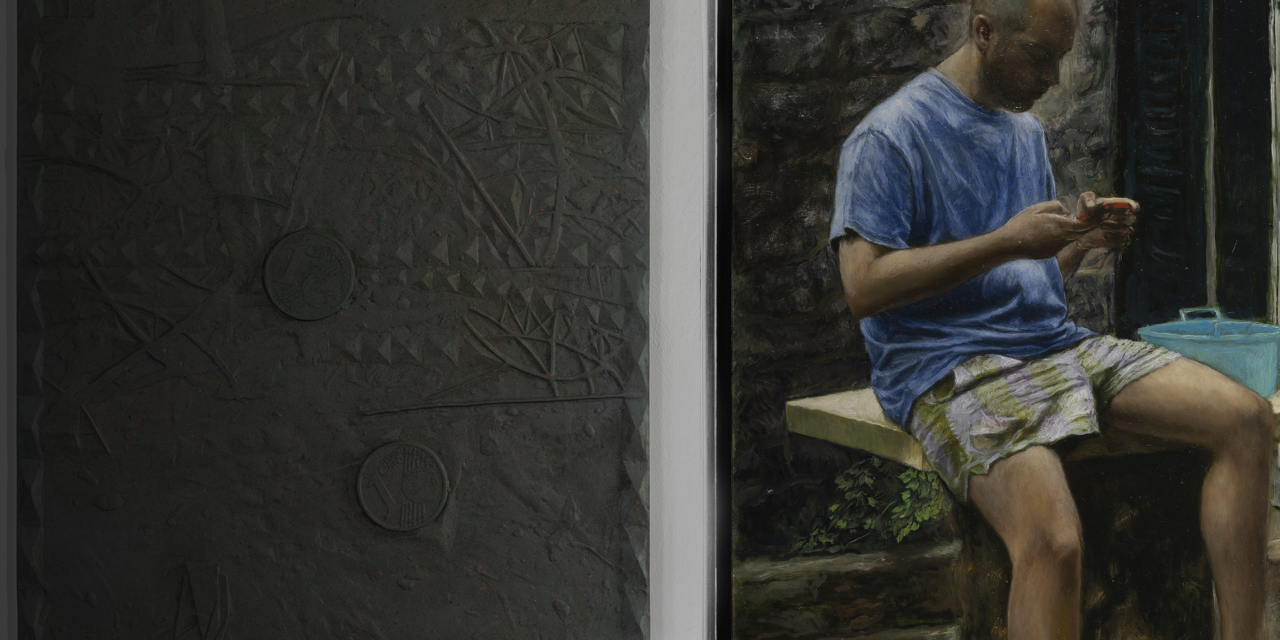

Financial Education

Podcast Academy

A new podcast series dedicated to Wealth Advisory is online.

The first four episodes are already available and offer an in-depth look at business consulting, real estate, art advisory and the complex issue of generational change.

The first four episodes are already available and offer an in-depth look at business consulting, real estate, art advisory and the complex issue of generational change.

Podcast - Good Morning Mercati

Press kit

/resolutions/res-640x360/Immagine_Blog_Generica-(1).jpg)