Sustainable governance

We believe that sustainability is the only path to growth: this is why we are committed to implementing the 17 Sustainable Development Goals of the United Nations 2030 Agenda.

Our sustainable approach

The Bank and its people are focused on protecting households’ wealth with integrity, passion and dedication, with an emphasis on long-term objectives. A commitment to pursuing sustainable growth requires the vision needed to understand and anticipate the challenges of innovation and the other transformation of our society, an inclusive culture, openness to dialogue and an informed approach to creating value for the Bank’s stakeholders.

Our goal: a sustainable growth

A responsibility for taking a long-term approach is an intrinsic part of our way of doing business, focused on protecting wealth according to a long-term vision. Therefore, we promote sustainable development that listens to all our different stakeholders, seeking to understand their real needs and matching them to the Company’s business goals. Excellence in the wealth advisory market cannot ignore the focus on value creation for all stakeholders who participate in and interact with that market: shareholders, financial advisors, employees and their family, customers, suppliers, communities — with whom the Bank has daily contact.

Our sustainability strategy is characterised by:

- sustainable growth over time, with entrepreneurial actions aimed at achieving long-term economic and commercial results, minimising risks related both to the volatility of the economic-financial scenario, and the inadequate planning of objectives, due to short-term needs;

- people enhancement, encouraging the constant development of skills and professionalism and acknowledging the contribution of individuals to the success of the organisation;

- sensitivity to the social context, participating in charitable, cultural and sports initiatives;

- reduction of environmental impacts linked both to our investments, by monitoring our exposure to high-carbon companies and to our operational activities, by taking measures to minimise the consumption of energy, paper and water, and to reduce greenhouse gas emissions to promote the energy transition towards an economy that protects the climate and biodiversity.

The year 2023 was complex and full of challenges that Banca Generali successfully overcame, as testified by the results achieved in terms of consistent and profitable growth — the best ever in its history. Net inflows for 2023 neared 5.9 billion euros, whereas total assets under management and under administration amounted to 92.8 billion euros. The Bank’s net profit rose by 53% to 326 million euros — the best result ever both by value and quality. The recurring component accounted for 98% of the total.

The Bank’s ability to grow did not impact its traditional capital solidity, which in fact continued to strengthen. Total Capital Ratio was 19.0%, or 6.7 pps above the specific capital requirement. In light of these results, the Board of Directors proposed to distribute a 251 million euro dividend — the highest ever in the Bank’s history — totally paid in cash.

Last year’s good figures appear even more significant when considering that they were achieved in a challenging context. Central Banks’ restrictive monetary policies and the ensuing sharp yield increase, the US banks’ liquidity crisis, the Credit Suisse bankruptcy and growing geopolitical tensions were complex challenges for the entire asset management sector. This was in addition to the impact of a particularly difficult 2022 — one of the worst years for financial markets in more than half a century, with investors squeezed between double-digit negative returns of both shares and bonds and significant inflationary pressures.

Banca Generali succeeded in coping with this difficult scenario thanks to its flexible business model and its service model diversification strategy, including in particular the decision to focus on comprehensive advanced advisory to manage its Costumers’ overall wealth (both financial and non-financial). Once again, the quality of our Financial Advisors made the difference: the existing network’s productivity — which was already a distinctive feature of the Bank — further grew, generating more than 85% of the overall net inflows. This value reflects the excellence of our professionals and confirms the Bank’s competitiveness in a context where households increasingly demand specialised advisory services.

In addition to the results achieved, the year 2023 will also be remembered for the strategic shift towards international expansion. In fact, the Company received the banking licence to operate in Switzerland, which will make it possible to grow on both the Italian and Swiss markets, optimising its position in the private banking and wealth management sectors.

The significant growth achieved by the Bank also extended to its commitment to sustainability objectives. These efforts culminated in various recognitions, including the overall improvement of the ESG ratings assigned by the main international agencies and Sustainalytics’ confirmation of Banca Generali’s top position in the “Diversified Financial” segment.

Our approach to offering sustainable solutions remained one of our distinctive elements and continued to meet with great attention amongst customers. Total ESG assets under Articles 8 and 9 of Regulation (EU) No. 2019/2088 both as direct investment and as underlying of financial and insurance investment solutions exceeded 16 billion euros, equal to 37.6% of total managed solutions. The Bank offers sustainable strategies that range from trends such as the circular economy and sustainable and medical technology to new methods of digital communication and social impact approaches.

Banca Generali also formalised its participation in the UN Global Compact, with whose principles it was already aligned. In accordance with the commitments made by signing the PRI and in compliance with leading market practices, the sustainable investment framework was further strengthened in 2023 through the adoption of the Active Ownership Policy, which defines the engagement and voting procedures with regard to the main issuers or funds under management in the portfolios of Banca Generali Group companies.

In addition, at the end of November 2023, the new Sustainable Advisor role was resented.

This role is filled by selected, highly specialised Financial Advisors dedicated to supporting and reinforcing the ESG commercial proposition and focused mainly on sustainable solutions. The initiative complements the path organised exclusively with MIP (Graduate School of Business of Politecnico di Milano), aimed at EFPA ESG Advisor certification, which involved 279 Financial Advisors in the past three years.

In 2023, particular attention was also paid to the Environment and Climate — a topic that was central to ESG training courses for Board members, Employees and Financial Advisors. Banca Generali’s commitment involves constant monitoring of the carbon footprint of direct investments and the relative emissions associated with the Bank’s operations. In confirmation of this, the project involving sustainable renovation of several branches and offices continued, with the goal of reaching a recycling rate (IRA) of > 95%. The MSCI ONE rating assigned to Banca Generali on the basis of its total Scope 1, 2 and 3 emissions confirmed that the Bank is in line with the climate alignment process towards the objective of keeping global mean temperature rise below 1.5°C.

With regard to sustainable commitments, the Company also implemented specific ESG due diligence relating to lending to companies engaged in high climate impact and high transition risk industries, as well as to all companies that have caused proved damage to the environment. As a result, the approach already adopted with regard to investments was also applied to lending policies.

People and their development are a priority in the Bank’s policies. Over the years, the Company has developed a solid programme of training and activity measurement, which involves transparent revision of the remuneration, incentive, and performance management models, also linked to ESG objectives. Last year, particular attention was devoted to initiatives focusing on gender and on the development of young people. In 2023, under-35 new recruits accounted for over 60% of new hires.

Moreover, last October the Global Pulse Survey was conducted on all Banca Generali Group Employees. The survey recorded a response rate of 94% and an engagement rate of 87%. Both rates grew compared to the previous edition, once more sending a positive, proactive message that confirms the strong sharing of the Bank’s overall goals and values. A sense of belonging and a strong company culture focused on shared goals and values are certainly highly distinctive factors of our Bank.

I would also like to underline that internal control adequacy and reliability were further strengthened, thanks to the implementation of various projects designed to guarantee that the Board of Directors has an increasingly complete vision of the Bank’s operations, fostering constant, constructive dialogue among all the Bank’s corporate officers and ensuring that company decisions are strongly supported by all.

To conclude, I would like to thank all the Financial Advisors, Employees, the Chief Executive Officer and his management team, whose work and dedication succeeded in turning a complex year into yet another year of extraordinary successes, growth, and value creation for all the Bank’s Stakeholders. I would also like to sincerely thank my colleagues, members of the Board of Directors, and the members of the Board of Statutory Auditors for their constant commitment and for ensuring the expertise and vision that succeed, year after year, to bring Banca Generali towards increasingly ambitious objectives.

Our Sustainability Policy outlines the system defined by the Banking Group for identifying, assessing and managing the risks connected with Environmental, Social and Governance factors in keeping with our goal of promoting sustainable development of business activities and generating durable value over time.

In particular, this Policy sets the rules to:

- identify, evaluate and manage ESG factors that may pose risks and opportunities for the achievement of business objectives;

- identify, evaluate and manage the positive and negative impacts that business decisions and activities may have on the external environment and on legitimate interests of stakeholders.

The Policy aims to integrate into business processes the Banking Group’s Sustainability model outlined in the Charter of Sustainability Commitments in force from time to time and approved by Banca Generali’s Board of Directors that defines the long-term strategic goals for doing business responsibly and living in the community, helping to create a healthy, resilient and sustainable society.

Internal Code of Conduct

In pursuing its growth objectives, we remain faithful to the fundamental principles that characterize its ethics, such as transparency, fairness and impartiality. These principles are reiterated in the our Internal Code of Conduct, which is in line with the rules of conduct reported in the Generali Group’s Code of Conduct.

The Internal Code of Conduct defines the minimum rules of conduct to be observed in dealings between colleagues, as well as with customers, competitors, suppliers and the Group’s other stakeholders and contains specific provisions governing the promotion of diversity and inclusion, protection of company assets, conflicts of interest, bribery, financial information and the processing of insider information, the prevention of money laundering, financing for terrorism and international sanctions.

Whistleblowing and AML/CTF Policy

To monitor compliance with the Internal Code of Conduct and in accordance with the applicable legal framework, we have adopted a whistleblowing procedure that makes it possible to collect, assess and manage reports of potential fraudulent phenomena, violations of internal rules and suspect behaviour. The procedure guarantees those involved protection from all forms of retaliation, discrimination or penalisation and ensures them the utmost confidentiality, without prejudice to legal obligations.

With reference to 2023, a report was received in relation to which the necessary investigations were conducted which led to the dismissal of the report itself at the beginning of February 2024.

In addition, with the aim of combating money-laundering and the financing of terrorism, which constitute a serious threat for the legal economy and can result in destabilising effects, above all for the banking and financial system, we have adopted an Anti Money Laundering and Counter Terrorist Financing (AML/CTF) Policy. The AML Policy, approved by the Board of Directors, is part of the broader internal control system of our Bank, aimed at ensuring compliance with applicable laws and regulations.

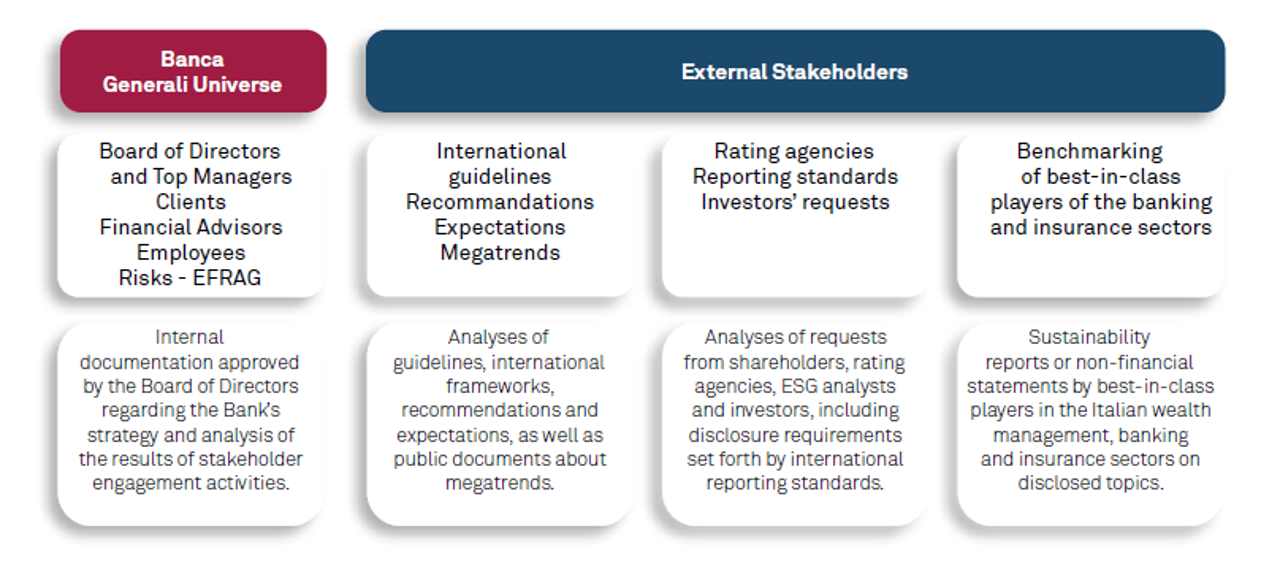

The materiality analysis is a tool for strategic reading of the Bank’s internal and external environment aimed at identifying and determining the priorities of the economic, environmental, social and governance aspects deemed material and significant to its business and its stakeholders. In order to efficiently identify the materiality of these impacts, we launched a structured process made up of the following 4 macro-phases and in compliance with the requirements set forth in the Sustainability Policy we analysed a wide range of internal and external sources of information.

Our documents were then organised in two clusters referred to our main stakeholders: on the one hand Banca Generali Universe and on the other hand the external stakeholders — according to a top-down approach.

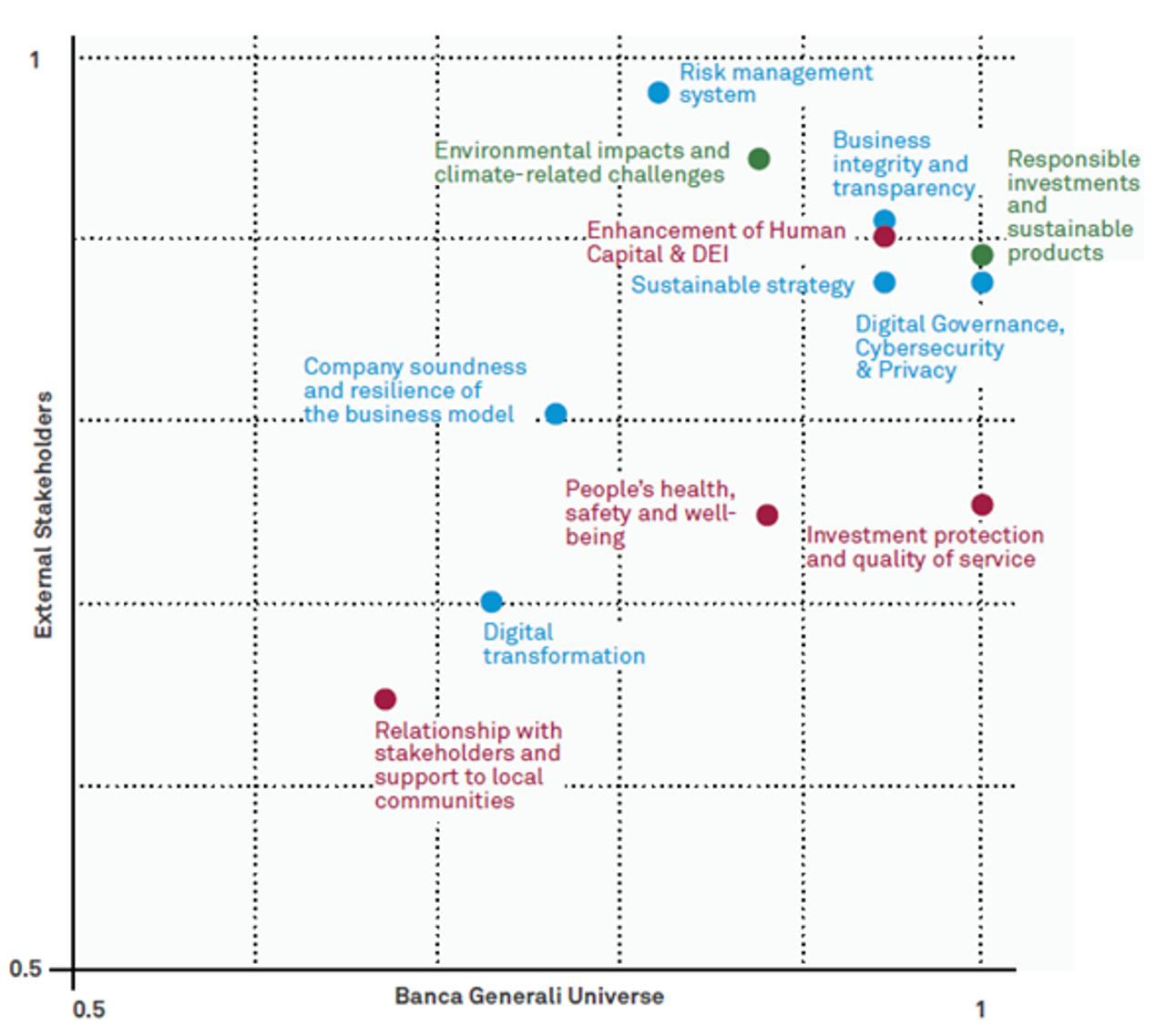

The analysis of the above-mentioned documents led to the definition of a set of 12 topics, identified, linked to the E, S or G areas and to the Pillars of the Strategic Plan.

In order to assess the materiality of the topics and the related impacts, we assigned a score equal to 0, 1.5 or 1 to each topic, based on the relevance of the topic itself and its connection to significant impacts on the economy, environment and people.

Afterwards, we assigned stakeholders an individual specific weight, based on their degree of materiality for the Bank. The score of each topic was then weighted accordingly.

The materiality matrix displays the topics on two dimensions — the internal (the Bank’s Universe) and the external (external stakeholders) dimensions — and positions them based on the scores obtained. The top right-hand corner plots the 12 priority topics, i.e., those with a score exceeding 0.5 in both analysis dimensions.

With particular reference to the Banca Generali Universe, the analysis confirmed as the most relevant topics responsible investments and sustainable products, digital governance, cybersecurity & privacy and investment protection and quality of service.

Considering the standpoint of external shareholders alone, a greater relevance was placed on the risk management system, environmental impacts and climate-related challenges, and business integrity and transparency.

Combining both universes, the most relevant topics were responsible investments and sustainable products, digital governance, cybersecurity & privacy, business integrity and transparency, and enhancement of Human Capital & DEI.

The correlation between the material issues and the GRI (Global Reporting Initiative) guidelines are reported below, with a focus on their internal and/or external impact.

The priorities that guide our sustainable business model are:

- Business management and culture dissemination

This topic extends both to our commitment to combating active and passive corruption through an adequate assessment of the associated risks and the adoption of safeguards designed to mitigate them and to the adoption of tools intended to govern the behaviour and spread the values that are the foundation of our company and commercial conduct.

- Governance and sustainable strategy

We have adopted a set of tools, rules, relationships, processes and company systems designed to ensure proper, efficient management of the organisation, with a particular focus on the challenges posed by the current environment and the management of new organisational models.

Moreover, the company strategy integrates environmental, social and economic considerations so as to create value for internal and external stakeholders from a medium-to-long-term perspective.

- Data protection and cyber security

In harmony with the process of accelerating digitalisation, we are committed to developing and enhancing adequate means and technologies to protect data and information technology systems in terms of availability, confidentiality and integrity.

- Investment protection and customer relations management

Our distinctive characteristics are our commercial model, based on a one-to-one relationship with our customers, and portfolio management focused on return and protection against all risks that, directly or indirectly, may compromise its value over time.

- Innovation and sustainable products

For us innovation implies, on the one hand, investments aimed at increasing the technological infrastructures to support the new offering of digital products and services, on the other, a focus on social, environmental and corporate governance issues, which are taken into account when designing products and services, integrating ESG criteria in the investment strategy of customers to raise awareness among them, and to deepen their knowledge of sustainability issues. Accordingly, we have identified and selected specialised partners with which to develop sustainable finance strategies, products and services.

- Business solidity

By ‘business solidity’ we mean the ability to maintain a strong performance over time and predict market trends, including through the renewal of the services offered, and development of robust organisational resilience in order to protect financial stability and business profitability.

- Growth and development of human capital

We promote the development of a company model capable of attracting talent and excellent professionals and harnessing the skills offered by our personnel through growth processes designed to hone their abilities and consolidate their professional expertise.

We view people as the centrepieces of our strategy: as a result, we develop initiatives and measures of various kinds designed to ensure equal opportunity and respectful, fair and flexible working conditions, while also avoiding all forms of discrimination. These range from work-life balance programs, a focus on individuals and attention to households, to engagement, development of growth and training initiatives and action plans for diversity and inclusion.

- Human capital protection

By ‘human capital protection’ we mean placing the protection of human capital at the heart of the organisation.

- Stakeholder and community relations

We believe it to be fundamental to listen to, consult and constantly engage stakeholders to understand their needs, while also contributing to the development of the community and local area. We also regard banks as contributing significantly to institutional debate for the development of mechanisms for economic facilities/support for individuals and businesses.

- Risk management system

We have set ourselves the goal of adopting a system for identifying, assessing and managing risks that includes ESG factors in order to integrate them into our strategy and operating model so as to govern the transition towards more sustainable economic and business models.

- Environmental impacts

To manage our direct environmental impacts, we have adopted policies aimed at enhancing efficiency and reducing consumption and greenhouse gas emissions; we also consider the indirect environmental impacts of investment activities on climate change and assess the climate risks of investment portfolios.

Discover our model of shared value creation to explore how the Bank translates these priorities into concrete initiatives that generate value that lasts over time and is shared with our stakeholders.

In Banca Generali we liaise with numerous stakeholders that differ by type, requirements and needs expressed. We recognise as stakeholders all those parties (Institutions, Organisations, groups or individuals) which, in a framework of shared but not always naturally converging interests, can influence or be influenced by its activities. The identification of stakeholders of priority interest for the Bank is carried out taking into consideration the following criteria: responsibility, influence, proximity, representation and strategy.

Overall, stakeholder listening and dialogue activities are carried out mainly in order to:

- understand the needs and expectations of stakeholders of priority interest in the medium to long term to support strategic planning;

- anticipate risks of a different nature (operational, reputational, etc.);

- monitor the level of satisfaction and check the extent to which the different stakeholder categories have a positive perception of their relationship with the Bank;

- seize new opportunities through the joint identification of solutions capable of creating shared value for the Organisation and its stakeholders.

Our awareness of the central role played by our stakeholders in the process of a sustainable growth, has engaged us in various forms of dialogue and discussion with them.

International and Financial Sector (including companies, media, non-profit organisations and the welfare industry)

- Local conventions on financial education

- Press conferences

- Company points of contact dedicated to media and institutional relations

- Meetings with institutions

- Multistakeholder meetings

- Social activities in favour of community

Shareholders & authorities (including shareholders, investors, analysts, proxy advisors):

- General Shareholders’ Meeting

- Quarterly reports

- Capital Market Days

- Media news

- Meetings and interviews with analysts, investors and proxy advisors

- International roadshows

- Digital channels and social media

Suppliers and strategic partners

- Meetings with bank and networks

- Working groups on common projects

- Participation in local meetings

- Media

- Events

BG Employees

- Periodic engagement survey

- Dedicated portal

- Monthly communications and newsletters

- Individual performance evaluation interviews and joint determination of development goals

- Roundtables with unions and workers' representatives

- Annual meeting with all employees

- Internal meetings and cascading initiatives

- Training activities and team building

- Survey on ESG matters

- Dedicated focus groups

Customers

- Surveys on the level of satisfaction

- Market researches

- Dialogue with consumer associations

- Communications channels devoted to customers (website, e-mail, toll-free phone number)

- Media

- Dedicated events

- Advertising campaigns

- Periodic documentation and in-depth reporting

- Social support activities

- Social media

Financial Advisors (network)

- Survey on ESG matters

- Dedicated portal

- Monthly newsletter

- Dedicated conventions

- Survey on the level of satisfaction

- Website and apps for mobile devices

- Media

- Training

- Local events

- Social media

Community

- Partnerships with observatories and research centres

- Dialogue with universities (e.g., Fintech & Insurtech Observatory of Milan Polytechnic; CeTIF Cattolica University of Milan)

- Website and social media

- Event organisation and participation in, sponsorship of and contribution to third-party events, such as collaborative projects on financial education (FEduF – Foundation for Financial Education and Saving; AbiEdu.n3.0) and cultural projects [BG Art Talent and Milano ArtWeek together with the Municipality of Milan; Banca Generali - Un Campione per Amico (A Champion as a Friend)

At Banca Generali, sustainability is an unquestionable strategic orientation supported by a strong internal commitment. In this regard, by amending the Rules Regulating the Proceedings of Meetings of Board of Directors and of Internal Committees, as approved on 11 May 2021, Banca Generali decided to integrate sustainability in its Managing Committee and all Board Committees.

The integration of sustainability in the aforementioned committees is briefly described below.

Internal Committees

- Managing Committee

The Managing Committee is an advisory body set up to assist the company’s top management by subjecting the Bank’s most significant strategic and managerial aspects to in-depth assessment, as a panel. It consists of the CEO, the two Deputy General Managers and top managers. It is in charge of examining, on a half-yearly basis, all matters related to the Banking Group’s social, environmental and sustainability responsibility, in accordance with the guidelines and principles defined by the Nomination, Governance and Sustainability Committee. In this context, the Committee defines sustainability-related opportunities, risks, common objectives, targets, areas for improvement, content and reporting methods, and analyses the results set out in the Annual Integrated Report, discussing the achievement of the targets set, the difficulties faced and the problems still to be solved.

Board Committees

- Nomination, Governance and Sustainability Committee

The Committee is responsible for advising and making recommendations to the Board of Directors on nominations, governance and sustainability. It supports the Board of Directors with integrating sustainability into the definition of business strategies, as well as the formulation of the materiality matrix; it oversees sustainability matters; it proposes to the Board of Directors any updates to the Sustainability Policy and all other internal policy documents that are ancillary and/or connected to the latter and designed to pursue the Sustainable Success of the Company and Banking Group; it examines the general outline of the sustainability reporting process; it formulates opinions and proposals regarding other corporate governance decisions to be made.

- Internal Audit and Risk Committee

The Internal Audit and Risk Committee performs supporting functions for the body with strategic supervision functions with regard to risks and the internal control system. It also ensures that the risks and profiles connected to ESG (Environmental, Social and Governance) factors are thoroughly assessed in order to foster the Sustainable Success of the Company and Banking Group.

- Remuneration Committee

The Remuneration Committee is responsible for advising and making recommendations on remuneration to the Board of Directors. It formulates proposals regarding plans, targets, rules and company procedures relating to social and environmental issues and, more generally, sustainability, in line with applicable laws and regulations.

- Credit Committee

The Credit Committee performs preliminary, consultative and propositional functions in support of the Board of Directors regarding loans, particularly the evaluation of loan applications. In supporting the Board of Directors to the extent of its remittance, the Committee ensures that the Board may adopt all appropriate lending resolutions in accordance with an assessment of the risks underlying the loans that also take account of the risks connected to environmental, social and governance (ESG) factors.

Management

All the competences regarding sustainability are attributed to the General Counsel Area, within which the Banking Group Sustainability Service was established, with the task of coordinating the structures of the banking group on strategic sustainability projects.