2018 Investor Day

Our strategic plan for the three years 2019-2021.

Ambitions

Consolidating its position of leadership in supporting the best Financial Advisors in managing their Clients and growing their portfolios.

Remaining Clients’ first choice in terms of the quality of its professionals, protection and value of service, with a digital presence consistent with best practices.

Creating a new engine of long-term growth through selective international expansion of the business.

Our financial targets

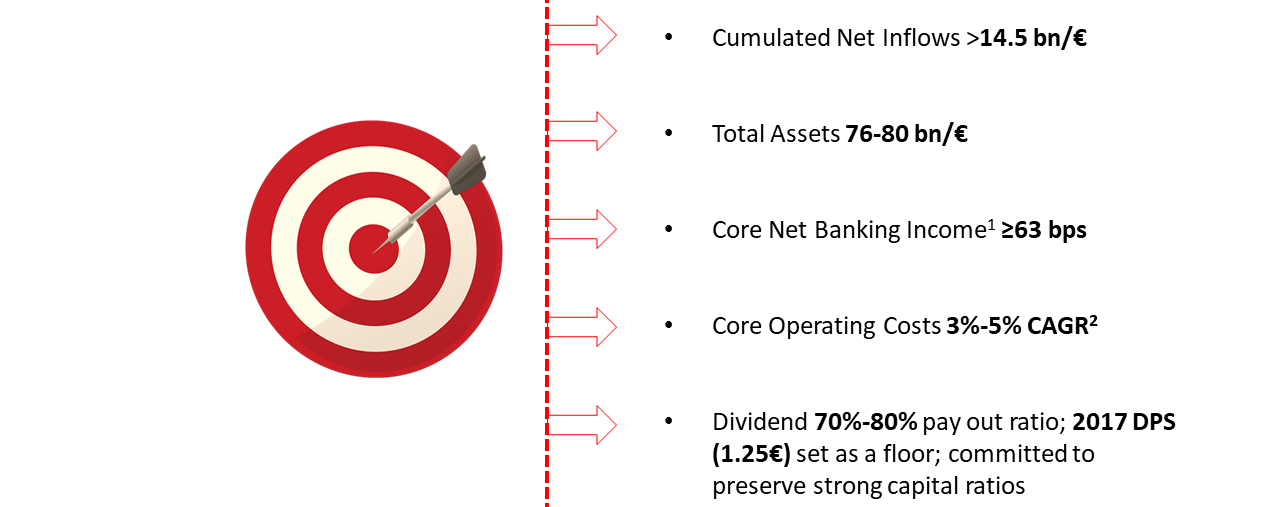

The targets presented to the financial community for the three-year period 2019-2021 are aimed at maintaining high levels of growth, profitability and shareholder remuneration, despite the changed market context. They include:

- cumulative net inflows of over 14.5 billion euros, due in part to advanced trading and internationalisation projects;

- assets under management of between 76 billion euros and 80 billion euros, with assets under custody in Switzerland of between 3.1 billion euros and 4.4 billion euros by 2021 and assets under advanced advisory in excess of 5.5 billion euros;

- a recurring net banking income of over 63 bps due to the development of new sources of recurring revenues and of net interest income, offsetting possible pressure on asset management margins;

- an increase in core operating expenses resulting in a 3-5% CAGR, despite the significant efforts in terms of growth and innovation;

- a payout ratio of 70% to 80%, with a minimum dividend per share in the three-year period of 1.25 euros, while maintaining levels of absolute capital solidity.

Investor

Discover our strategy

We want to realise our ambitions through six strategic guidelines.