Shared Value Creation Model

We believe in long-term growth by creating value for our people and communities, while protecting the planet.

The responsibility to think long term is in the DNA of our asset protection business with a long-term vision.

This is why we promote the idea of sustainable development that listens to all stakeholders, trying to understand what their needs are in order to combine them with the corporate business objectives and remaining in line with our Mission and our Vision.

Our strategy is to offer our customers the opportunity to invest according to their values and principles, contributing to sustainable growth over time with an entrepreneurial action aimed at achieving stable and satisfactory long-term economic-commercial results, reducing the associated risks both the volatility of the economic context and the inadequate planning of objectives.

The principles we aspire are based on a ESG approach and we apply them at each phase of our value chain and that we manage through the Sustainable Governance model.

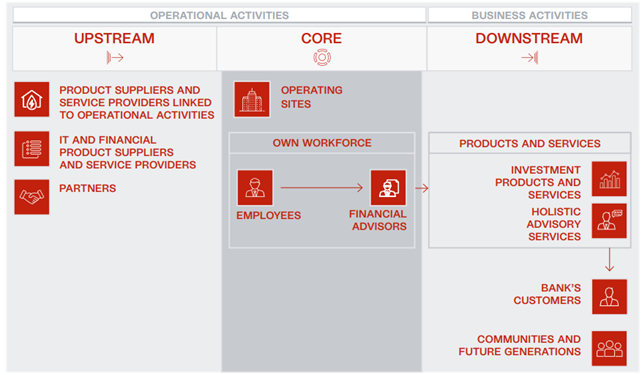

Our value chain

We stand out within the Italian finance industry for the central role of the investment services — and more specifically financial advisory and wealth management services — we offer to HNW, Private and Affluent customers. In particular, with our services we reached a total of 359,000 Customers at the end of 2024, and a total of 103.8 billion euros AUM.

Our Value Chain aims at maximising operational efficiency, constantly innovating and offering a wide range of high-quality services to our Customers, fully reflecting our mission and vision statements. It is divided into three main segments:

These three phases respectively focus on: efficient resource management (Upstream), ongoing development of workforce and technological innovation (Core) and provision of high-quality services and holistic advisory (Downstream).

Creation and Distribution of Value Added

The creation of value for all our stakeholders is one of our key objectives.

Most of the economic Value generated is distributed to the various stakeholders with which Banca Generali comes into contact in the course of its day-to-day operations, including Shareholders, Suppliers, Financial Advisors, Employees, the Government and, finally, the community and the environment.

In 2024, our business system also retained — in the form of retained earnings, depreciation and amortisation, residual provisions for risks and changes in deferred tax assets and liabilities — the total amount of 197.4 million euros, or 12.3% of the economic value generated. The amount is to be regarded as an investment that the other categories of stakeholders make each year in order to keep the Company in efficient condition and foster its development.