Automotive does not run, in the first half of the year 32% drop

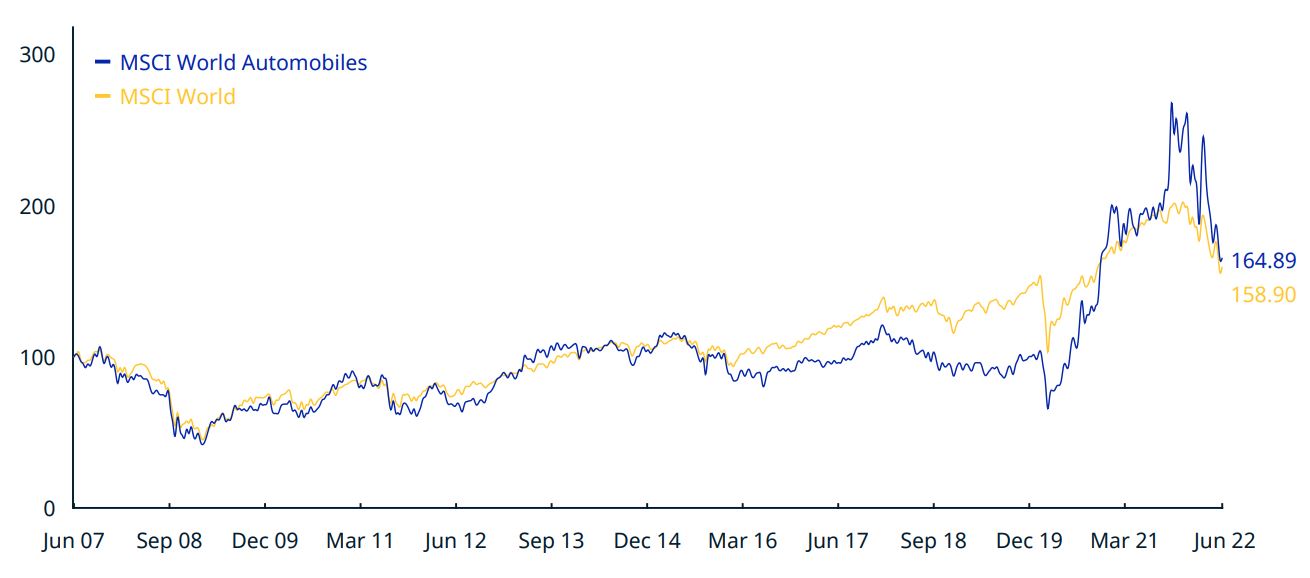

A decline of more than 32 percent in six months. That's the less-than-exciting performance recorded (in U.S. dollars) in the first half of the year by the Msci World Automobiles Index, the index that groups the stocks of the world's largest publicly traded automakers.

This is a far more pronounced decline than the average international stock market when one considers that the Msci World (the basket representing the largest companies in all sectors listed on international stock exchanges) lost about 10 percentage points less, or just over 21 percent, over the same period. Also down 30 percent semi-annually was the Msci Auotomobiles & Components, which also includes companies that produce components for automobiles.

So, if the first half of 2022 was bad for almost all financial markets in general, it was even worse for automakers' stocks (and their suppliers). For what reason?

Source MSCI

The conflict between Russia and Ukraine and the consequences in the automotive industry

Generating the declines was a mix of factors. The difficulties began as early as 2021 as demand for goods and services gradually picked up after pandemic restrictions around the world. Since then, there has first and foremost been a worldwide shortage of semiconductors (or microchips), which are now critical components for many industries, including the automotive industry.

Nor did this microchip shortage benefit from the outbreak of the conflict between Russia and Ukraine, since the latter country is the world's leading producer of neon gas, a raw material widely used in the semiconductor industry. Precisely the conflict in Ukraine was another element that worsened an already problematic scenario because, apart from the case of microchips, the already significant general increase in the prices of energy, fuels and most of the raw materials that feed the auto industry was accentuated after the outbreak of the conflict.

As a result of these concomitant forces, there has been a consistent increase in list prices of cars and a vertical collapse in registrations. According to estimates by the Fleet&Mobility Study Center, before Covid, the average unit price of cars was 21 thousand euros , rising to 22,400 euros in 2020 (+7 percent) and 24,300 euros in 2021 (+8 percent). However, for some types of services related to the automotive sector, such as rentals and car sharing, there have been year-on-year price increases of more than 30 percent in recent months, according to Istat. A bloodletting for consumers, in short, which has had as an indirect consequence a drop in registrations in Europe of more than 16 percent in the first half of 2022, with peaks of 22 percent in the Italian market.

Stellantis, General Motors and Ford: the best of the last six months

Of course, it should not be forgotten that the above scenario has already been widely anticipated by the financial markets in the past months. The declines in automakers' stocks are there to prove it, and given current prices, in a well-diversified portfolio, therefore, stocks or bonds in this sector may well find room.

In fact, it should be remembered that there are automakers that have shown solidity despite difficult times. Stellantis, for example, reported better-than-expected quarterly results in the first quarter of 2022, with revenues up 12 percent, following higher prices and a smaller-than-expected drop in sales volumes. For 2022, the company reaffirmed previous guidance and said it expects 100 percent revenue growth by 2030, with more than 20 billion euros in cash flow.

Among U.S. automakers, on the other hand, General Motors has improved its operational capacity and profitability by investing heavily in electric and autonomous vehicles and now benefits from a demand for vehicles that, at least overseas, will outstrip supply through the end of 2022, supporting its ability to price and pass on rising commodity costs to consumers.

Also in the United States, the restructuring story of Ford Motor should be noted, which is gaining ground and has good liquidity to finance its product plans and reposition its core automotive business in the various regions in which it operates. Despite the delicate moment, in short, the automotive sector retains valuable corporate stories.

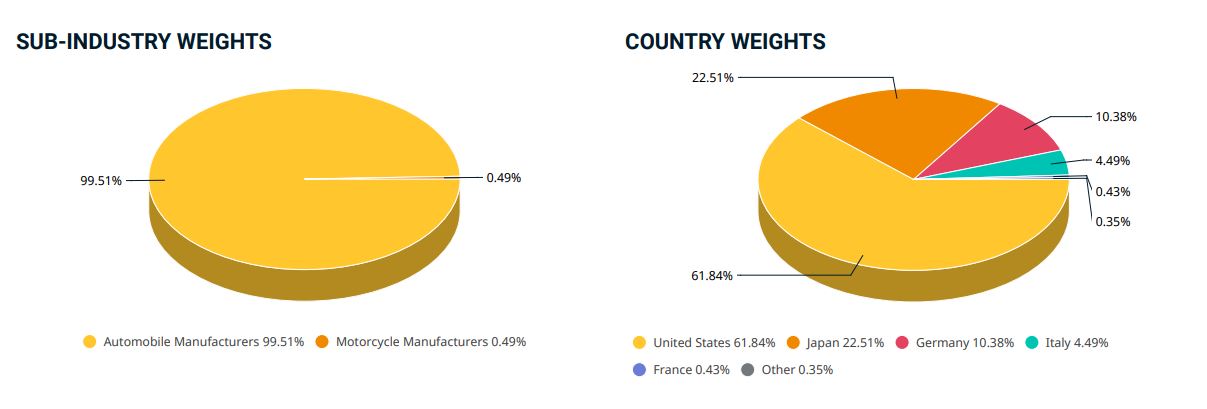

Source MSCI

Are you interested?

Leave your info here to find out more and be contacted by one of our financial advisors!

Thank you, you will be contacted as soon as possible

Thank you, you will be contacted as soon as possible

Error while saving data, try again later